As paralegals we are full of ambition, drive, and love for our craft. As we grow and evolve into our paralegal careers, we eventually become accustomed to routine. Our experiences and years of experience and mistakes begin to shape our expectations of a case. No two cases are the same, sure. But the process is largely the same for each case.

For every client that has Medicare, there is a personal injury paralegal expecting a headache at some point.

For every letter of protection, there is a personal injury paralegal preparing to negotiate with a billing or subrogation company.

It is those things that have the potential to derail all of our hard work leading up to settlement.

Trust me, I’ve been there when its time to disburse and you don’t have all the pieces to the puzzle, and you’re stuck looking like you have a clown filter on your face. Congrats, you just created more work for yourself by having to hold money in escrow.

Paralegals have influence over adjusters and the medical billing community. One of the things I take pride in most as a personal injury paralegal is the ability to build relationships with total strangers over the phone and through simple e-mail correspondence.

When you’re able to establish respect for someone, their job, and what they have to do, you will be able to work more efficiently to resolve cases benefiting everyone involved, most importantly your client. It’s simple, people who want to work with you, will be more likely to work with you when you need them to. When I am able to see reductions in client medical bills by more than half, I know I am doing something right.

Depending on the complexity of the case, settlement and disbursement will look a lot different for each of us. You want to make sure you have done everything you can so that when it’s time to disburse you have an accurate distribution sheet. You’ve worked relentlessly to get a handle on all medical bills and liens. You will have triple-checked client out of pocket expenses, spent hours making a thorough medical summary, paving the way for your attorney to guide the clients to resolving their claims.

These five tips will help ensure that when you’re ready to disburse, you will have a handle on your client’s medical bills and liens to fast-track their settlement after a personal injury claim.

1. Identify potential liens and PIP status

Just do yourself a favor and know early on in the case your client’s health insurance status and where they stand with their PIP benefits. It can become extremely complicated when your client’s treating physicians are not rowing in the same direction when it comes to submitting their bills.

You have to make sure everyone, including your client, understands what to do for submitting bills. You’ll need to analyze your client’s health insurance co-pays and deductibles in comparison to their income status, and subrogation language of the health plan. Especially if you’re considering entering into a letter of protection.

Send a letter to your client’s treating physicians instructing them how to submit their bills. For me, it’s providing the PIP information first, then contacting each provider once PIP exhausts.

Preparing your clients ahead of time is key to navigating letter of protections and ERISA plans. The bills and liens will need to be repaid somehow, but the expectation will always be that you as their paralegal will do your best to maximize their recovery! Having a firm handle on medical bills early on pays off in the long run when it’s time to disburse.

Personal Injury Paralegal Boot Camp

As a personal injury paralegal, you have an important role in the pre-litigation phase of your claim files.

But where do you even start when you’re managing 80+ active files?

This online course will give you all the tools to manage that heavy case load. It walks you through every phase of your personal injury claim files, from the case intake through the demand package and more.

2. Excel is your friend!

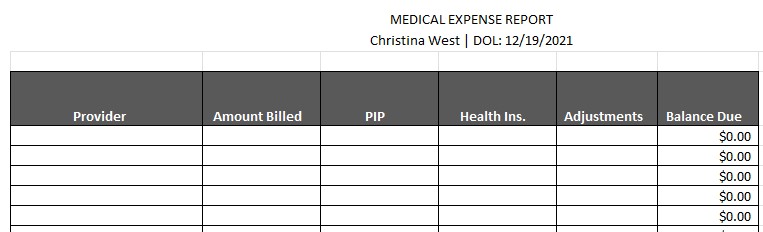

At first, I was overwhelmed by the power of an Excel spreadsheet. It turns out, it’s an extremely useful tool for tracking your client’s bills and accident-related expenses. Using Excel, I created a medical bill expense report. I look at the client’s bills, the PIP payment log, explanation of benefits (EOB), and lien summaries, to stay on top of the accident-related treatment.

Determining the value of a case depends upon the paralegals ability to keep track of the bills in an organized and efficient way. As soon as I am assigned a case, I assign this spreadsheet to the client. I input any bills or EOB’s the client gave us, and as the client treats and I receive EOB’s, I update the form and mark a star on the EOB which lets me know it is accounted for on my spreadsheet.

With the Excel spreadsheet you can create columns and rows that allow you to keep track of your client’s accident expenses such as:

- total medical bills

- out-of-pocket expenses

- healthcare liens

- outstanding bills

It is super easy for the attorney to read and follow. The first column is for provider date and service, the second is for the total amount billed, and the third is for what PIP paid. The remaining rows consist of any health insurance payments, adjustments, client payments, and then a final column for any balance due.

Each row is for the date of service and at the bottom of the rows it totals the columns. With a few simple formulas, this form has saved me a ton of time, especially when negotiating with adjusters and preparing the distribution sheet for settlement.

3. Put everyone on notice

When settlement negotiations start, it would be a good idea to go ahead and put everyone on notice that settlement is potentially near.

- When dealing with Medicare, you are familiar with the portal and can notify them of the anticipated settlement.

- If you have a letter of protection, it would be a good idea to start crunching the numbers to ask for a reduction.

- If you’re working with a subrogation company, let the analyst know the last date of treatment so they can run one last report to send a final lien.

Not only is this beneficial to fast-tracking disbursement, but it also sends a distinct and clear message about professional courtesy. Don’t expect someone to drop what they are doing to get you what you need, but when they do – make sure you praise them for it because it’s worth praising. When you’re able to get into the habit of providing notice, it gives people time to prepare, and we can all appreciate that!

4. Start asking for reductions at the first offer

Reductions give you settlement leverage and are important when negotiating with adjusters, so getting those numbers as early as possible gives your attorney a great advantage. So, when that opening offer comes through, I look at my Excel spreadsheet and review what has PIP paid of the bill already, what has health paid, and what adjustments have already been made.

When I’m analyzing client reductions, I have to make sure the numbers support my proposal. For example, when a provider has been paid 75% of their total bill already by PIP, it justifies my request to waive the remaining balance.

I don’t think it’s any secret that health insurance companies contracted rates are low with providers, so there is some incentive for providers to work with attorneys’ offices because they have the potential to recover more of their bill. You should also remember to be very realistic about what payments can be made. You don’t want to promise one provider a large pay out on their $43,000 bill when there is only $40,000 in available coverage. Being open and transparent with the medical billing community will ensure that your reduction negotiations run smoothly for final settlement.

5. Double-check firm costs

Each law firm will have their own procedure for invoices with the common end goal of making sure none of them are left behind for the firm to absorb as a loss. I usually prefer to forward an invoice for payment as soon as I receive it, mark a note on the hard copy, and when I received the payment stub, I file it within the client’s hard file.

We all know how easy it can be for a medical records invoice or court reporter fee to get lost in the sauce when you have emails flying back and forth all day. I want to make sure firm costs are accounted for when it’s time for settlement because we have taken such a huge risk to advance all of the hard costs up front to obtain the necessary records to settle the claim. When those numbers match up on the distribution sheet, it’s one less thing you have to worry about.

Whatever you do in your paralegal role, you want to make sure that when it’s time to disburse, you have accounted for everything. I want to know early on in the case what I’m getting into because then I can have a real conversation with the attorney about how to set client expectations. It is important to be as thorough as possible and have a firm handle on final numbers so disbursement is clear of any hiccups, or worse malpractice.

Sharing my spreadsheets and checklists with clients is something I do often because it is such an easy way to include them in their case. I familiarize myself with the people who handle the billing matters. Creating and establishing a professional relationship with clients and medical providers is so important as a personal injury paralegal.

When my clients pick up their settlement checks, they are confident in me that I have accounted for everything.

Meet the Author

Hello, my name is Christina West. I am a personal injury paralegal with the law firm, Baird Mandalas Brockstedt, LLC. I started my career with the firm almost six years ago. I have five beautiful children and live in Delaware at the beach. I am also a Delaware Certified Paralegal and the Newsletter Editor for the Delaware Paralegal Association’s newsletter, The Reporter. I love spending time with my family, music, and reading a good book.